We are now in February 2010, and I am observing the unfolding of a dual situation which I think has a chance of being mutually detrimental to both countries in 2010. There is no getting away from the fact that Australia has an incipient property bubble, with a recent world wide housing survey showing that Australia has the most unaffordable housing in the world. Click the link for the DHI PDF of the survey.

For a more in depth look at how the Australian bubble developed and went on steroids since 2009 check out Steve Keens blog-post on Its Debt, Debt Debt for Australia. In this post Steve Keen talks at length on how Australians household debt levels surpassed the United States, and how the misguided policy actions of the Australian Government in reaction to the Global Financial Crisis has set Australia up for a hard landing, probably not in the too distant future. Keen writes,

"We actually began to reduce our debt levels before America—with household debt falling from 99% to 96% of GDP in March 2009. but then the federal government’s First Home Owners’ Boost began to kick in (it was introduced in October 2008, and I railed against it at the time—see “Rescuing the Economy or the Bubble?”). This enticed new entrants into mortgage debt in record numbers: during the life of the Boost, over 1 percent of the Australian population took the government’s additional $7,000 bribe down to the bank, and levered it up five or more times with a mortgage. Even though households were reducing other forms of debt, total household debt rose until it cracked the mark of 100% of GDP in the last month."

I believe based on the evidence, and having now seen and observed in real time what a housing bubble looks like, and what it smells like in the form of the US housing bubble, the Irish housing bubble and the UK property bubble, that Australian housing prices will be heading south in the not too distant future. This will have a detrimental effect on the Australian Dollar, which I believe will correct significantly against the USD.

There are a number of factors I see weighing on the AUD over the next few months. Below you can see the RBA decisions starting in October 09 to start increasing rates, due to fears of inflation, and possibly this was some kind of recognition that houses prices had risen too far. At the time the initial rise took the markets by surprise, and of course it added to the carry differential which has been positive for the AUD against lower yielding currencies. At the next two meetings the RBA continued with the 25 basis point rises, taking rates to up to 3.75% at the present.

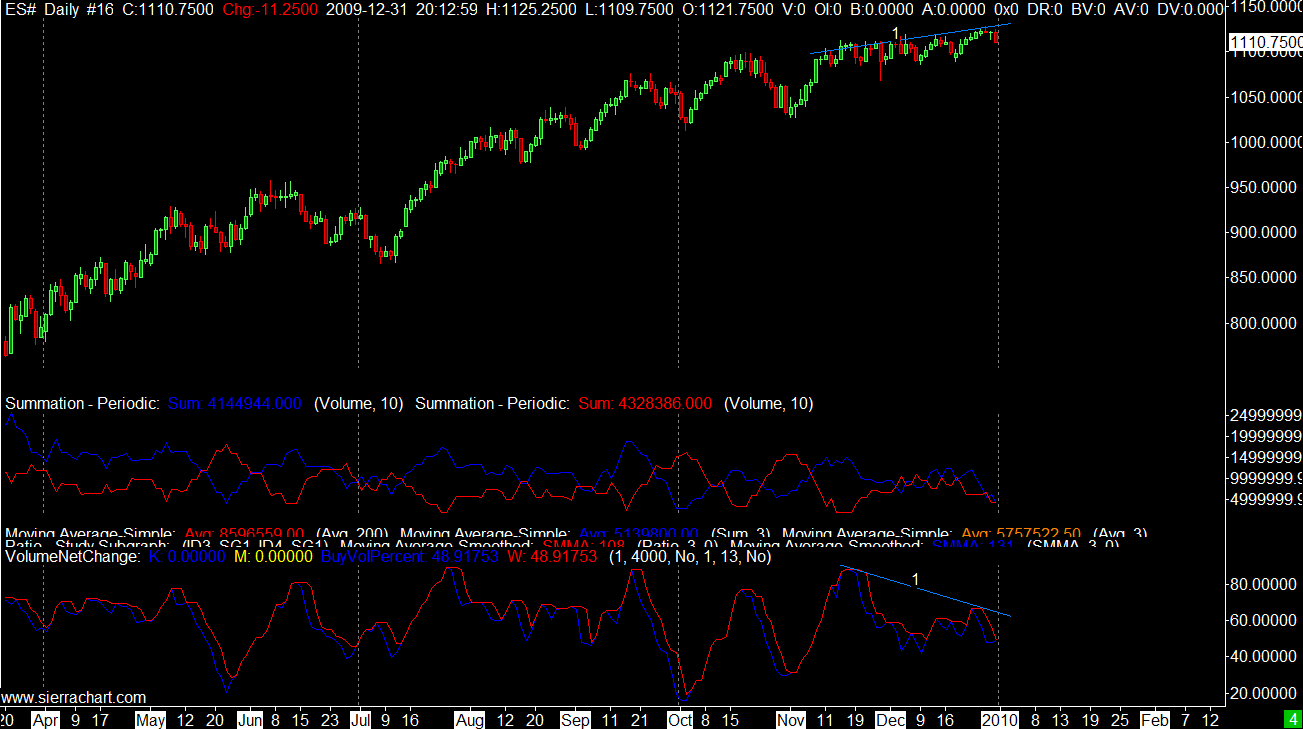

However, on checking the chart below one can see that the first interest rate rise lead to the high for the year for AUD. The rate rises were already baked into the cake after the first rise, as the AUD failed to gain any further ground. In all likely hood the statement from the RBA at the time was so hawkish that the market had baked into the cake the further 2 rate rises during the initial rise. At the time I remember thinking that they have set out from the traps far too early with these rises, and when the real estate bubble pops they will quickly reverse these. At the time I was thinking possibly March 2010, but that now seems a little premature, although with general sentiment turning quite negative at the start of 2010, and the tangible fear of some kind of sovereign default perhaps a turning point is not too far away. At the last meeting the RBA decided to take a breath and pause with the rate increases for the time being, even though the market was pricing in an increase.

| Goods | Services | Total | % share | Rank | ||

|---|---|---|---|---|---|---|

China |

| 57,922 | 5,831 | 63,753 | 13.2 | 1 |

Japan |

| 54,617 | 4,965 | 59,582 | 12.3 | 2 |

United States | 34,930 | 14,742 | 49,672 | 10.3 | 3 | |

Singapore |

| 19,025 | 9,017 | 28,042 | 5.8 | 4 |

United Kingdom | 16,808 | 8,891 | 25,699 | 5.3 | 5 | |

Republic of Korea | 20,415 | 2,416 | 22,831 | 4.7 | 6 | |

New Zealand | 16,476 | 5,976 | 22,452 | 4.6 | 7 | |

Thailand |

| 13,448 | 2,729 | 16,177 | 3.3 | 8 |

Germany |

| 12,026 | 2,235 | 14,261 | 2.9 | 9 |

Malaysia |

| 11,567 | 2,497 | 14,064 | 2.9 | 10 |